IEP FELLOWS AND YOUNG SURGEONS COURSE

Kameron Helmuth, CFP®, CHFC®, & Brad Quick, CEPA®

Abstract: Recently, some published literature has highlighted the lack of general financial training and resource for among attending surgeons1,2 , while at the same time other studies have highlighted the tie between burnout and financial stress3. The purpose of this study is to investigate the most critical areas of financial concerns among Orthopedic Surgeons with a variety of tenure, from different practice and compensations structures to identify key areas to focus on.

Background: The recent IEP (Interactive Educational Program) Tampa course was designed to cover many critical & professional issues modern-day surgeons are facing. The authors’ company (Vestia Personal Wealth Advisors, LLC), has supported these IEP events since 2020, with a goal of providing solutions to issues raised regarding Financial Knowledge, and the tie to Surgeon Burnout. With this in mind, we have crafted this study and obtained our first IEP data set from the surgeon attendees. Our goal is to continue to deploy this survey over upcoming industry courses to obtain statistical significance and report our findings.

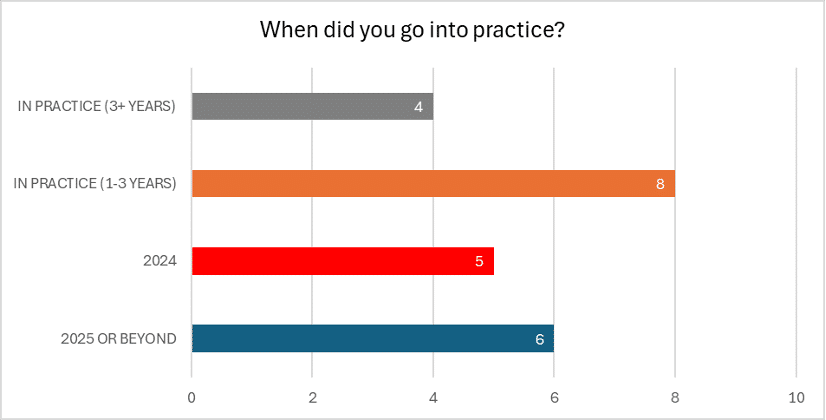

Methods: An online survey was offered to all course participants in a recent Industry Course to gauge what topics would be presumed as the most critical financial pain points for Orthopedic Surgeons. 26 surgeons participated from varying institutions, subspecialties, and career status. Three questions were asked:

- When do you go into practice?

- How would you rate your financial knowledge?

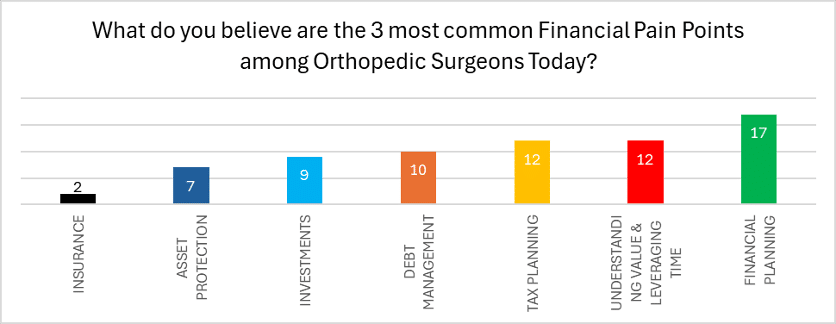

- What do you feel are the 3 most common financial pain points among Orthopedic Surgeons today?

- Do you work with a Physician focused Financial Advisor currently?

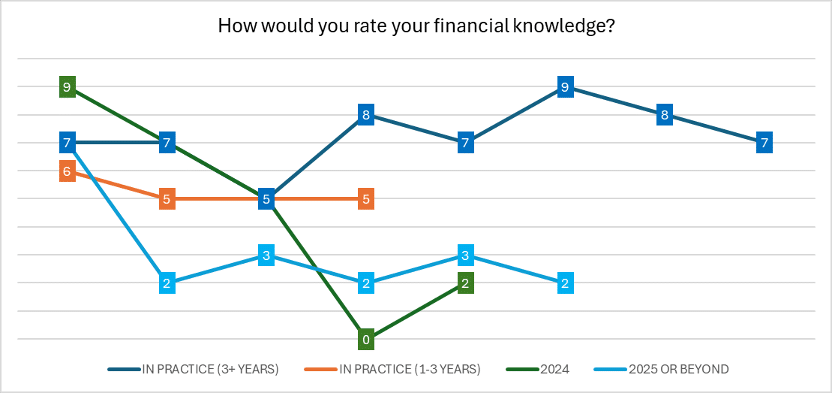

The results from this study have been summarized below. Survey respondents ranked their top three choices among the 7 key financial areas they face.

Results: Physicians from multiple career stages reported varying degrees of financial knowledge with an average score of 5 across all participants. Financial Planning was chosen as the most common pain point among Orthopods with 17 votes followed by Tax Planning and Understanding Value & Leveraging Time each receiving 12. Only 2 participants elected Insurance.

The ranking of financial knowledge increased as a surgeon entered practice. This is likely due to the onslaught of important financial decisions that are brought on during the transition to practice, considerations of first contracts, and beginning to balance spending, savings, and paying down debt. Additionally, on average financial knowledge increased when working with a Physician focused Advisor, as on average the score was 4.7 for the 15 Surgeons who do not work with a Physician focused advisor, while the 8 Surgeons who do report a 6.4 on average.

Conclusions: With an average rating of 5, we see a clear void of formal financial training for the physician community. This is supported by the number one pain point being listed as Financial Planning. An interesting observation is that in our perspective, financial planning should be the wholistic treatment of all other pain points listed such as taxes, investing, debt management, and asset protection. Often these are thought of as separate issues but a thorough financial plan for surgeons should incorporate all disciplines listed and we often see one or more being overlooked.

Another common concern we see is the intentional effort to tackle important issues such as tax planning and investments, but this requires a cohesive strategy to bring them all together which is typically absent. This can create inefficiencies and demand additional time/energy for somebody to act as the middle-person, often times the physician themselves. Once a surgeon understands the true value of their time, both financially and intrinsically, they often find that leveraging a trusted financial first-assist can alleviate anxiety and drastically improve efficiency. We believe that once a surgeon can create a dynamic plan that aligns their resources with financial priorities and family values, and surround themselves with the appropriate team, their likelihood of achieving their version of success is greatly increased.

This primary data set has begun a process of capturing data necessary to make an impact to some of the most critical issues facing Orthopedic Surgeons today. More study and data gathering is necessary to crystalize a plan to address and will be forthcoming.

References:

- The case for needed financial literacy curriculum during resident education, Gianakos et Al, Journal of Surgical Education 2022

- An assessment of residents’ and fellows’ personal finance literacy: an unmet medical education need, Ahmad, International Journal of Medical Education. 2017;8:192-204

- How do Areas of Work Life Drive Burnout in Orthopedic Attending Surgeons, Fellows, and Residents? Clin Orthop Relat Res (2021) 479: 251-262

Investment advisory services offered through Vestia Personal Wealth Advisors, Vestia Retirement Plan Consultants, and Vestia Advisors, LLC, a Registered Investment Advisor with the SEC. Securities offered through Ausdal Financial Partners, Inc., 5187 Utica Ridge Rd, Davenport, IA. 52807 (563)326-2064. Member FINRA/SIPC. Vestia Personal Wealth Advisors, Vestia Retirement Plan Consultants, Vestia Advisors, LLC and Ausdal Financial Partners, Inc. are independently owned and operated. This material should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor.