The One Big Beautiful Bill for America (OBBBA) was signed into law last week, and our team has since been laser focused on how this new law will specifically affect physician finances and planning. Most physician households will experience only slight changes from the prior tax environment to the new landscape under OBBBA. We are thinking ahead for the back half of 2025 to ensure we’re proactively focused on the physician families who may be more impacted or who may have new opportunities to consider.

Because there are so many items to cover, we’re breaking our analysis into a three-part series:

- Part 1 (this article): Personal income tax changes that affect physician households

- Part 2: Changes impacting medical practices and physician-owned businesses

- Part 3: Updates to student loans and repayment strategy considerations

The legislation itself is lengthy (over 1,000 pages!) so this is not an exhaustive summary, but meant to be a higher-level overview tailored to physician families.

Please Note: We are not accountants. We collaborate closely with trusted CPAs and tax professionals, but this article is for informational purposes only and not intended to provide tax advice.

Before we dive in, it might be helpful to recap a couple of key tax terms that we will be using throughout (and if you’re already familiar with tax terminology, feel free to scroll right past this section!)

- A Deduction reduces your taxable income, which in turn lowers the amount of tax you owe. To estimate the value of a tax deduction, you can multiply the value of the deduction by your tax bracket.

Example: If you earn $400,000 and claim a $10,000 deduction, you’re only taxed on $390,000. In the 32% tax bracket, you’re effectively saving $3,200 ($10,000 X .32) by taking this deduction.

- A Credit is more valuable than a deduction. It reduces your actual tax bill, dollar for dollar.

Example: If you owe $20,000 in taxes and get a $2,000 credit, your final tax bill drops to $18,000. You save the entire amount of the $2,000 credit!

- The Standard Deduction is a fixed amount the IRS lets you subtract from your income (as in, pay zero taxes on) without any detail, paperwork, or qualification needed.

Example: A married couple filing jointly can automatically deduct $31,500 in 2025.

- Itemized Deductions are specific expenses (like mortgage interest, property taxes, or charitable donations) you can list to reduce your taxable income instead of taking the standard deduction. You would only use this if your total expenses falling in the itemized deduction category add up to more than the standard deduction everyone gets. Most physician households in our experience use itemized deductions versus the standard deduction, but if you’re not sure where you fall your advisor or accountant can clarify!

Example: If your itemized deductions total $40,000 and you’re married filing jointly, you’d skip the $31,500 standard deduction and deduct the $40,000 instead.

- A Phaseout reduces or eliminates certain tax benefits at higher income levels. At physician income levels, many physicians are phased out of tax deductions or credits that more average-income households benefit from. We may not even mention a new deduction or credit if most physician households eclipse the income threshold for the phaseout!

Example: A tax credit may begin to phase out once your income exceeds $200,000, meaning you’ll get a smaller credit, or none at all, if you earn more than that.

Now that you’re oriented to the terminology, here’s what you need to know about the OBBBA as it applies to personal income taxes:

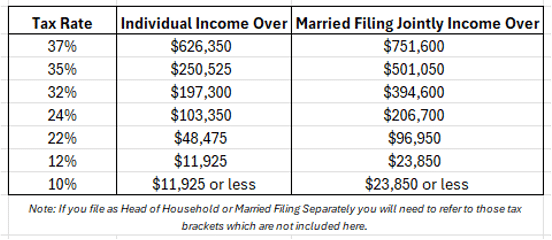

- The tax brackets from the Tax Cuts and Jobs Act in 2017 (TCJA) were made permanent (shown below), so the highest tax bracket will be 37% indefinitely. Prior to the OBBBA, the top tax bracket was set to return to 39.6% in 2026.

- The Standard Deduction from the TCJA has also been extended indefinitely. For 2025, the Standard Deduction is $15,750 for single filers and $31.5k for married filing jointly, and this will continue to increase for inflation each year moving forward.

- For those who take the Standard Deduction, there is a new opportunity to deduct charitable contributions of up to $1,000 for single filers and $2,000 for married filing jointly. This is great news for charitably inclined households who use the standard deduction and were previously unable to deduct charitable contributions!

- The child tax credit (remember a credit decreases your tax bill dollar-for-dollar), available if you have children under the age of 17, increases from $2,000 per child to $2,200 per child. There are phaseouts beginning at $200k for single filers and $400k for married filing jointly. This was initially set to expire after 2025 but is now available indefinitely and will be indexed for inflation moving forward.

- A new type of investment called a Trump Account is available for children up to age 18 and can be funded with up to $5k/year. Babies born between 2025-2028 will receive “seed” funds of $1,000 from the government and parents can contribute in addition. We are working to learn more about the details of these accounts, but it seems they fall somewhere between 529 accounts and UTMA accounts in terms of tax benefits and flexibility. You can discuss more with your advisor if you have questions about these accounts for your children.

- Multiple changes were made to Itemized Deductions:

- The available deduction for State and Local Taxes (SALT) increases from its current $10k cap (both single filers and married filing jointly) to a $20k cap for single filers and $40k cap for married filing jointly through the year 2030. However, there is a phaseout on this higher cap that starts at $250k (single) and $500k (MFJ). This higher SALT deduction will benefit some physician households especially in states with state income tax, but many will still only be able to deduct $10k due to the phaseout.

- Mortgage interest remains deductible on up to $750k of primary residence debt.

- For those who itemize, charitable contributions are only deductible to the extent that they exceed 0.5% of your income. For example, if your Adjusted Gross Income is $500,000, you can only deduct charitable contributions over $2,500 (500,000 X .005). If you itemize deductions and currently make charitable contributions, it’s worth a conversation with your accountant and/or advisor about strategies that may allow you to accelerate some deductions into 2025 before this new rule goes into effect in 2026.

- Starting in tax year 2026, taxpayers in the 37% tax bracket will only get to take a 35% deduction for their itemized deductions.

- There is a new deduction available for car loan interest paid up to $10,000 for any qualifying car loans incurred after December 31, 2024. The vehicle’s final assembly must have occurred in the US to be eligible. This will primarily benefit resident and fellow physician households as there is a phaseout that begins at $100k for single filers and $200k for married filing jointly. But if you are newer to practice and thinking of financing a car soon, it’s worth a conversation with your advisor or accountant to see if you could qualify!

- There are new deductions available for $25k of tip income and $12.5k if single or $25k if married filing jointly of overtime income. This doesn’t apply to many physicians directly (both because most physicians don’t have this type of income and there are low phaseouts), but we mention it because some of you have asked about it in relation to your young adult children!

- Beginning in 2026, you will be able withdrawal up to $20k/year from 529 accounts (up from $10k/year) for qualified K-12 expenses. This was previously limited to tuition, but the definition is being expanded to include certain non-tuition expenses like tutoring, standardized testing fees, and books and other curriculum materials.

- The annual contribution limit for dependent care flexible spending account is increasing from $5,000/year to $7,500/year beginning in 2026. Your employer will have to update their plan to allow for increased funding – it’s not automatic. We estimate the average physician utilizing these accounts to pay for a portion of their childcare will save over $800 in tax with this increased contribution limit!

And finally for today, a note on estate and gift taxes!

- The estate and lifetime gift tax exemption is the total amount you can give away, either during your life or at your death, without paying federal gift or estate tax. This amount currently sits at $13.99 million and was set to cut in half starting in 2026 which would have resulted in many physicians needing to consider additional estate planning strategies. The OBBBA increased the exemption to $15 million per person for 2026 which will continue (indexed for inflation) indefinitely.

If you have specific questions about how any part of the bill may affect you, don’t hesitate to reach out to your advisory team. As always, we are here to help!

Knowledge gives us the power to plan with intention. With the rest of the year ahead, we have time to evaluate how these upcoming tax law changes may impact you and whether there are proactive moves that could better position your household for the shifting landscape. Be sure to be on the lookout for parts two and three coming soon!